Navigating the property market in Australia can be challenging, especially with rising house prices and interest rates. However, if you’re a medical professional, you have some distinct advantages when applying for a home loan or refinancing your existing mortgage.

These benefits could make all the difference, and we’re here to guide you through the process.

One of the key ways to maximise these advantages is by working with a knowledgeable mortgage broker. A good broker understands the unique benefits available to medical professionals, such as special loan packages, waived lender’s mortgage insurance (LMI), and more flexible lending criteria.

By leveraging these benefits, a broker can tailor the loan options to suit your specific needs, potentially saving you thousands of dollars and making your path to property ownership smoother.

Lower risk, bigger loans

Lenders are required to have a range of policies in place to make sure borrowers can repay their loans.

But people in stable, high-paying professions are regarded as low risk borrowers.

This includes people working as:

- Anaesthetists

- Audiologists

- Chiropractors, osteopaths and physiotherapists

- Cosmetic surgeons and plastic surgeons

- Dentists and orthodontists

- Dermatologists

- General practitioners

- Midwifes and obstetricians

- Nurses

- Occupational Therapist

- Ophthalmologists and optometrists

- Paediatricians

- Pathologists

- Pharmacists

- Podiatrists

- Psychiatrists and psychologists

- Radiographers and radiologists

- Registrars

- Speech pathologists

- Staff specialists

- Surgeons and specialists

- Veterinarians.

What are the potential benefits?

If you work in one of these fields, lenders will often offer higher borrowing limits, sometimes allowing you to borrow up to 90-100% of the property value without Lenders Mortgage Insurance (LMI).

Possible LMI waivers for medical professionals can apply even when borrowing more than 80% of the property value, saving you thousands of dollars.

Many lenders can also offer special discounts and everyday low interest rates on home loans for doctors and medical professionals.

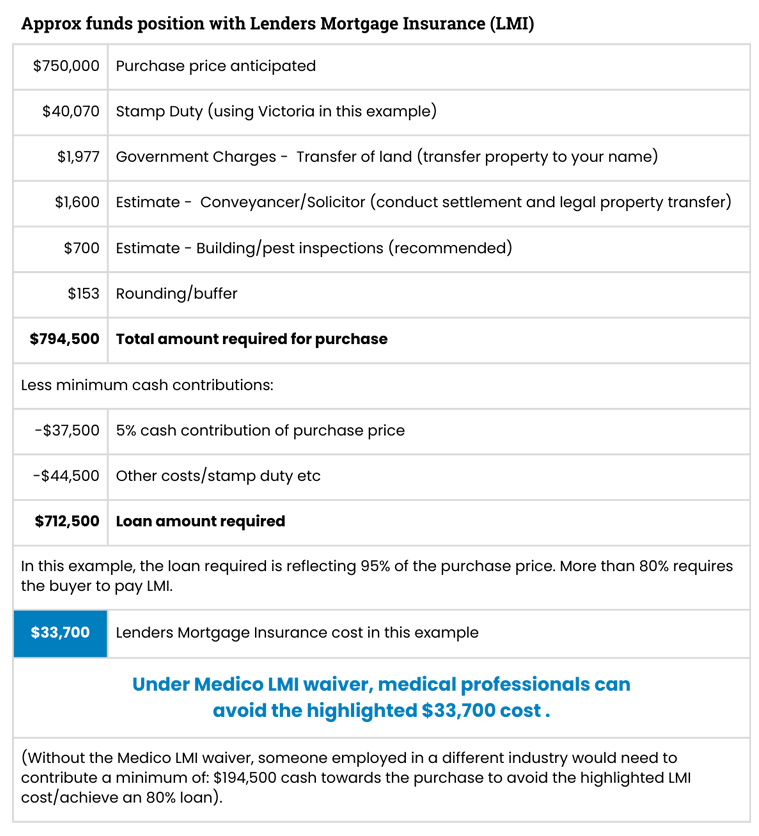

The following table illustrates an example of the potential savings when utilising the Medico LMI waiver. In these scenarios, a borrower can avoid the substantial cost of LMI, resulting in a more favourable financial position compared to those in other industries who would need to provide a much higher cash contribution to bypass this insurance.

Eligibility requirements

Lenders will need to see proof of your occupation, including your current generalist or specialist registration.

You may also need to provide evidence of your qualifications and any specific professional associations you may need to belong to.

Who should I talk to?

Our expertise can help you unlock the full potential of these opportunities, ensuring you make the most of the favourable conditions available to you as a medical professional. Let us help you take that crucial step towards securing your dream property.

Our team is experienced and ready to support you when it comes to purchasing or refinancing.

Contact us here at Endeavor Finance on 03 5434 7690 or by email at [email protected]