Investing in property is a popular way to build long-term wealth in Australia. However, the biggest hurdle many people face is coming up with the required deposit.

Traditionally, most buyers have focused on saving a 20% deposit in cash to secure a loan for an investment property. But there’s an alternative that could accelerate your journey into property investment: using the equity in your existing property.

Let’s explore how leveraging equity instead of cash can work for you, and why having a lump of savings isn’t always necessary to get started with property investment.

What is equity and how can you use it?

Equity is the difference between the current market value of your property and the remaining balance of your mortgage. Over time, as you pay down your mortgage and as property values appreciate, the equity in your home grows. This equity can then be accessed to secure an investment loan.

For example, let’s say you own a home valued at $800,000 and have an outstanding mortgage balance of $400,000. You have $400,000 in equity. While you may not be able to access all of this, banks often allow you to borrow up to 80% of your home’s value, minus your remaining mortgage. In this case, 80% of $800,000 is $640,000, so you could potentially access $240,000 of your equity for investment purposes.

Why use equity rather than cash?

- No need for a lump of cash

One of the biggest advantages of using equity is that you don’t need to have a large amount of cash saved up to buy your next property. For many investors, saving for a 20% cash deposit on an investment property can take years. By using the equity you’ve already built in your existing home, you can potentially fast-track your investment plans without having to wait until you have significant savings.

- Leverage your existing property

Leveraging equity allows you to use an existing asset to acquire another one, effectively amplifying your wealth-building potential. This strategy helps you diversify your portfolio while your initial property continues to grow in value. By borrowing against your home’s equity, you retain your savings for other potential investments or personal needs.

- Tax benefits

Borrowing to invest in property has potential tax advantages. The interest on your investment loan is often tax-deductible when you borrow for income-generating purposes, such as buying an investment property. This makes the overall cost of borrowing lower compared to other forms of debt, such as personal loans or credit card debt, where interest isn’t tax-deductible.

Borrowing against equity Vs. Saving a cash deposit

Now, let’s compare the two options: borrowing against your equity versus saving for a cash deposit.

Borrowing against equity

Speed: This allows you to purchase an investment property much sooner, as you won’t need to wait years to save up a deposit.

Maximising wealth: By purchasing sooner, you can benefit from potential property price appreciation, rental income, and tax advantages.

Leverage: You’re using your existing assets to grow your wealth rather than depleting your cash reserves.

Risks: Your overall debt level increases, and if property values decline, your equity could be impacted. Careful consideration of interest rates and repayment terms is essential.

Saving for a 20% cash deposit

Time-consuming: It may take several years to save up a 20% deposit in cash, during which time property prices could increase, making it harder to enter the market.

Opportunity cost: While you’re saving, you miss out on potential capital gains and rental income from owning the property.

Lower debt: With a cash deposit, you may borrow less and have lower mortgage repayments, but you’ll also reduce your available liquidity.

Savings flexibility: Cash savings give you flexibility for other uses (emergencies, personal expenses), but tying them up in a property deposit can reduce your financial cushion.

Why consider equity?

The key takeaway is that you don’t necessarily need a large cash deposit to start investing in property. By using the equity in your current home, you can access an investment loan and enter the property market sooner. This strategy offers the advantage of leveraging your existing assets to grow your wealth while keeping your savings intact for other opportunities.

However, it’s essential to approach this with careful planning. Increasing your debt through an investment loan can heighten your financial risk, particularly if interest rates rise or property prices fall. Speaking with a financial adviser or mortgage broker can help you assess your financial situation and determine if leveraging equity is the right strategy for you.

Investment loans, when used wisely, are powerful tools to accelerate wealth creation. If you’ve built up equity in your home, it may be worth considering this as a pathway into property investment. With the right guidance and strategy, you can unlock the potential of your existing assets and move closer to achieving your long-term financial goals.

Example: borrowing against equity

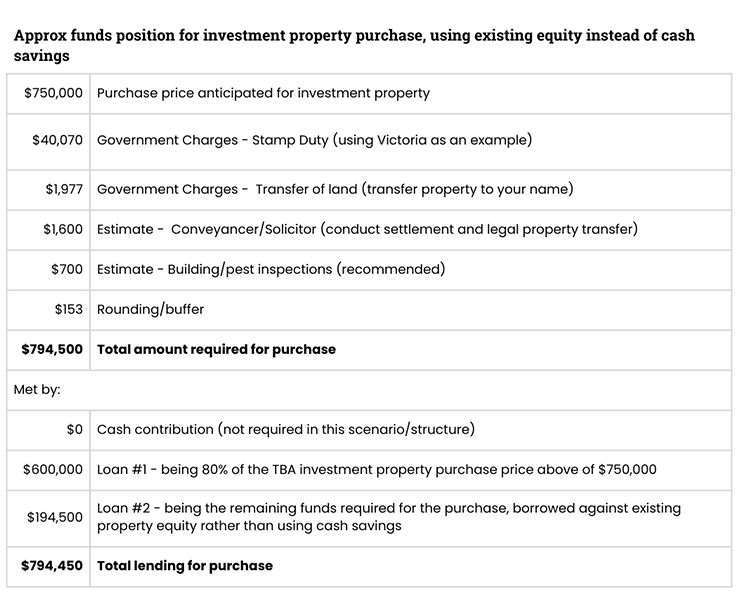

See this example below for an approximate funds position for investment property purchase, using existing equity instead of cash savings.

In this example we’ve borrowed $194,500 against clients existing house equity rather than using cash savings, which is comfortably under the $240,000 available equity mentioned earlier in this blog post Overall the ‘loan value ratio’ is below 80% so no Lenders Mortgage Insurance is applicable, however we’ve effectively borrowed 100% of the property purchase price + related purchase costs, with an appropriate structure.

We can also look to separate the portion of $194,500 (Loan #2) on a separate loan account, to keep both properties separate and not ‘cross secured’ or ‘cross collaterlised’. This can prove useful for growing investment loan portfolios and having ‘split banking’ with different banks.

Need tailored advice? Reach out to us at Endeavor Finance for a consultation to explore how you can use equity to build your property portfolio and secure your financial future.